Benefits of CPACE Financing

CPACE Lending is a national leader in the CPACE marketplace, dedicated solely to providing long-term CPACE financing to commercial property owners seeking to lower energy costs, reduce their carbon footprint and increase property values. CPACE Lending has access to all CPACE capital providers to provide you the best rates in terms in the market. CPACE Lending is able to close transactions in eligible CPACE markets nationwide.

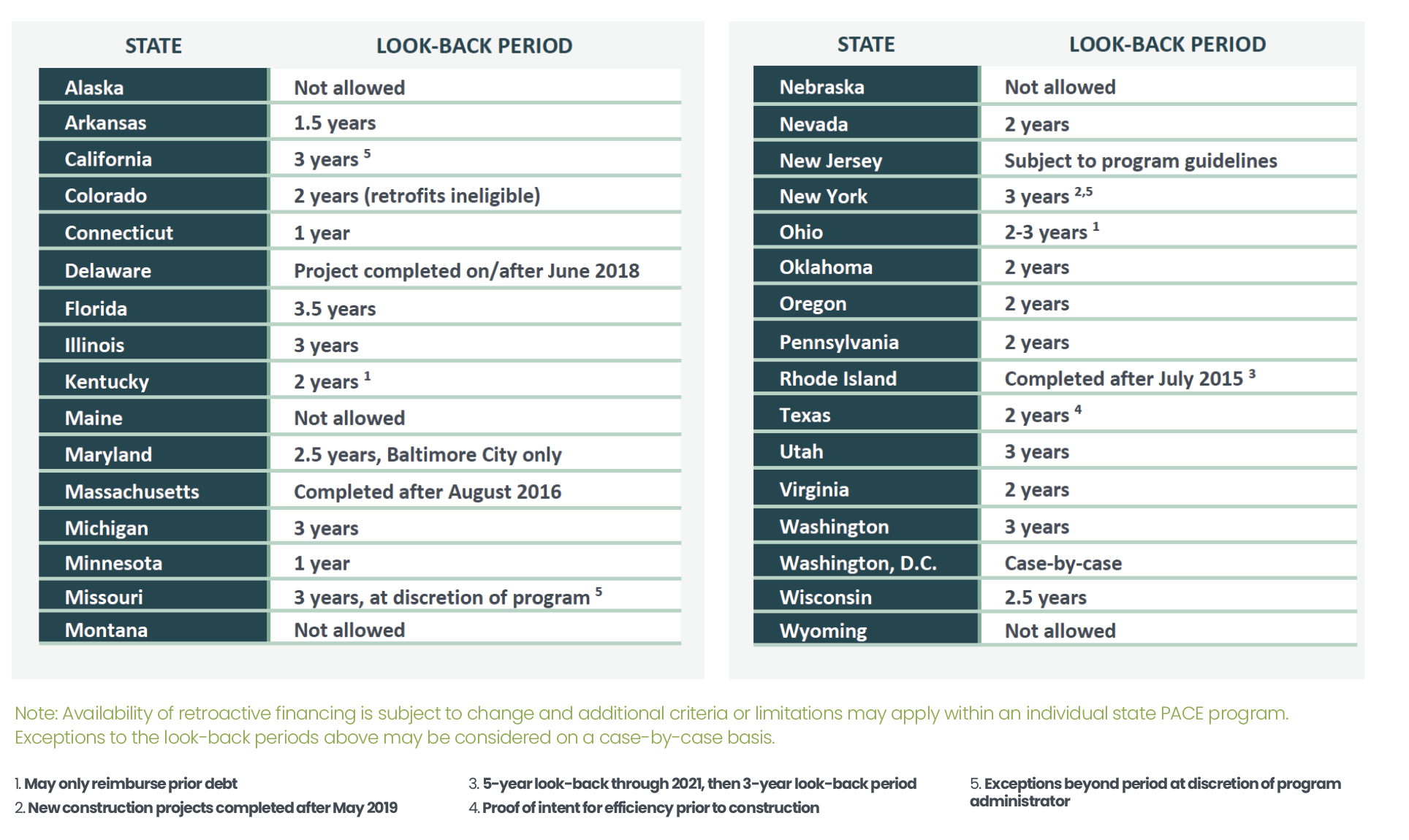

Eligibility for Retroactive Refinancing

per State Guideline

Retroactive financing with CPACE can help commercial property owners and developers shore up capital stacks and access liquidity at any point in the economic cycle, but it becomes especially beneficial during periods of capital market constriction and economic uncertainty like we are experiencing today. Retroactivity is generally available as follows:

Benefits of using CPACE Financing

100% financing of hard and soft costs with no out-of-pocket fees

Increases net operating income and property value

Fixed-rate financing with up to 30-year terms

Ability to recover as an operating expense

Displaces higher cost mezzanine and equity capital

Decreases utility and maintenance costs

Promotes economic development and urban revitalization

Facilitates sustainable building design

Non-recourse…. No Personal Guarantee

Non-Accelerating and transferable

Interest only options available

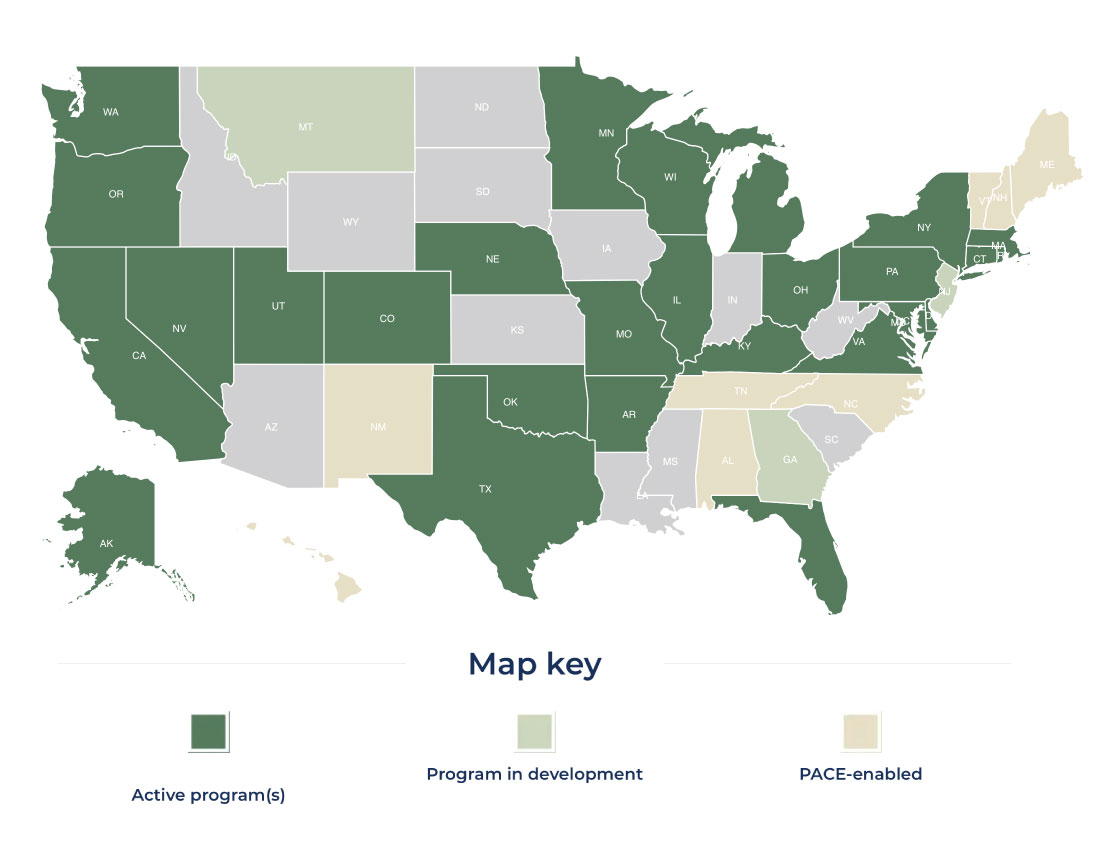

Approved CPACE States

PACE-enabling legislation is active in 38 states plus D.C., and PACE programs are now active (launched and operating) in 28 states plus D.C. Residential PACE is currently offered in California, Florida, and Missouri.

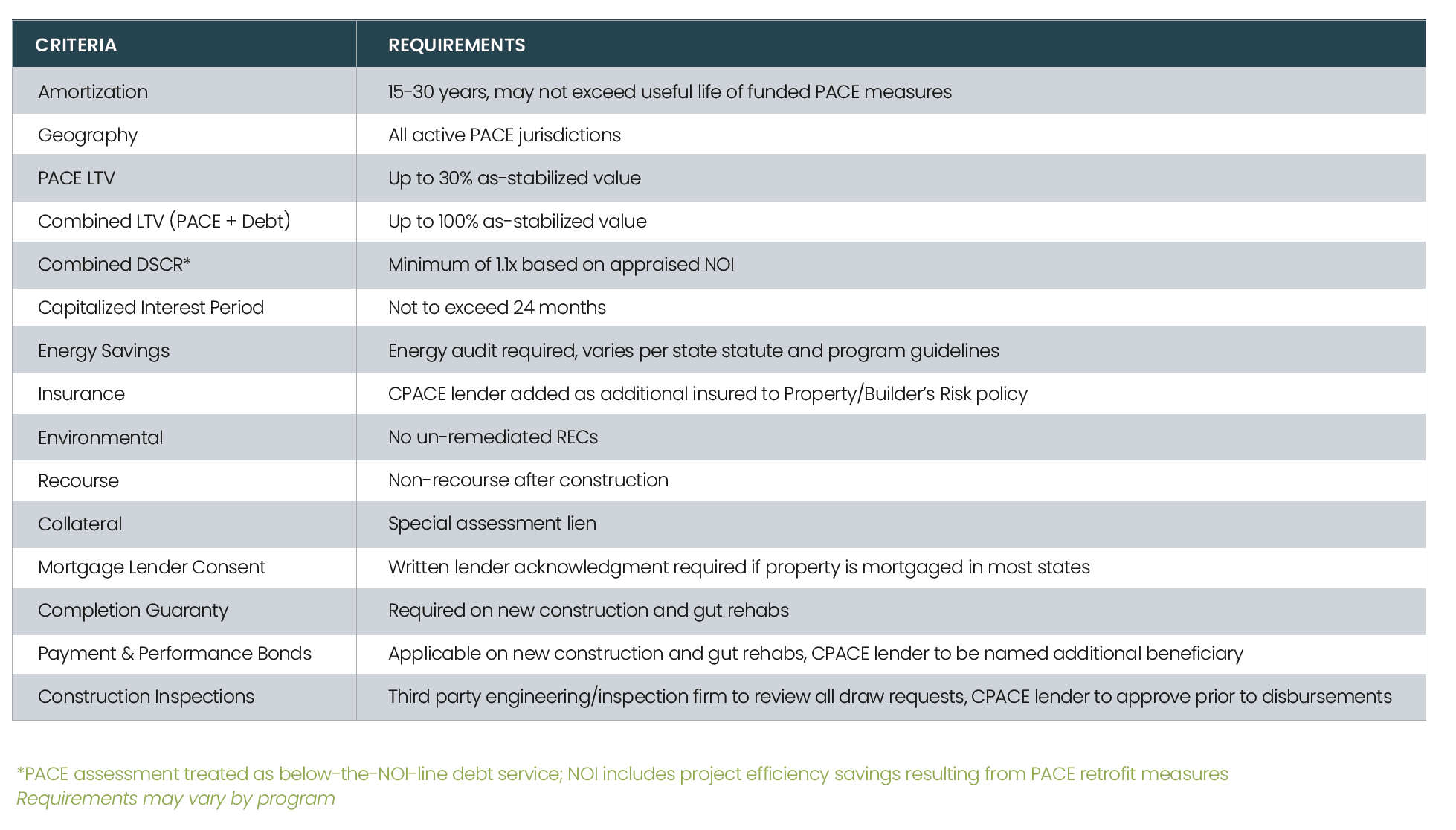

CPACE Guidelines

UNDERWRITING PARAMETERS

Loan Amounts: $1mm to $950mm